Do you ever feel like you’re being watched? Right now, ~6,500 satellites are orbiting overhead, ~900 of which have been launched into orbit for purposes of “Earth observation.” These 900 sets of eyes stream photos, videos, and information on Earth’s physical, chemical, and biological vital signs.

In combination with terrestrial and aerial sensors, our planet is being watched closely - and increasingly closer and closer. Earth Observation and Intelligence companies have boomed as the focus on finding that next black (green?) edge shifts from internal business operations to external market context.

What data matters?

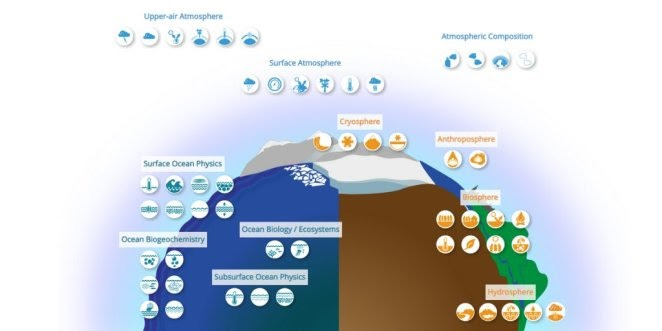

The Global Climate Observing System (GCOS) identifies 54 groups of essential climate data variables, as CTVC’s Kobi Weinberg previously wrote about. These physical, chemical, and biological variables provide empirical measurements of Earth’s vital signs. The essential climate variables can be grouped into three domains – land, air, and sea

Land

Data examples: above-ground biomass, river discharge, snow cover

Representative startup: Planet Labs’ constellation of >200 satellites gathers imagery to identify land changes, and pollutants

Air

Data examples: carbon dioxide and methane levels, air temperature

Representative startup: Aclima develops Internet-connected air quality sensors and software to map pollutants

Sea

Data examples: ocean temperature, salinity, waves, surface content

Representative startup: Saildrone collects ocean data using a fleet of unmanned surface vehicles (USVs) to provide around-the-clock observations of the ocean surface

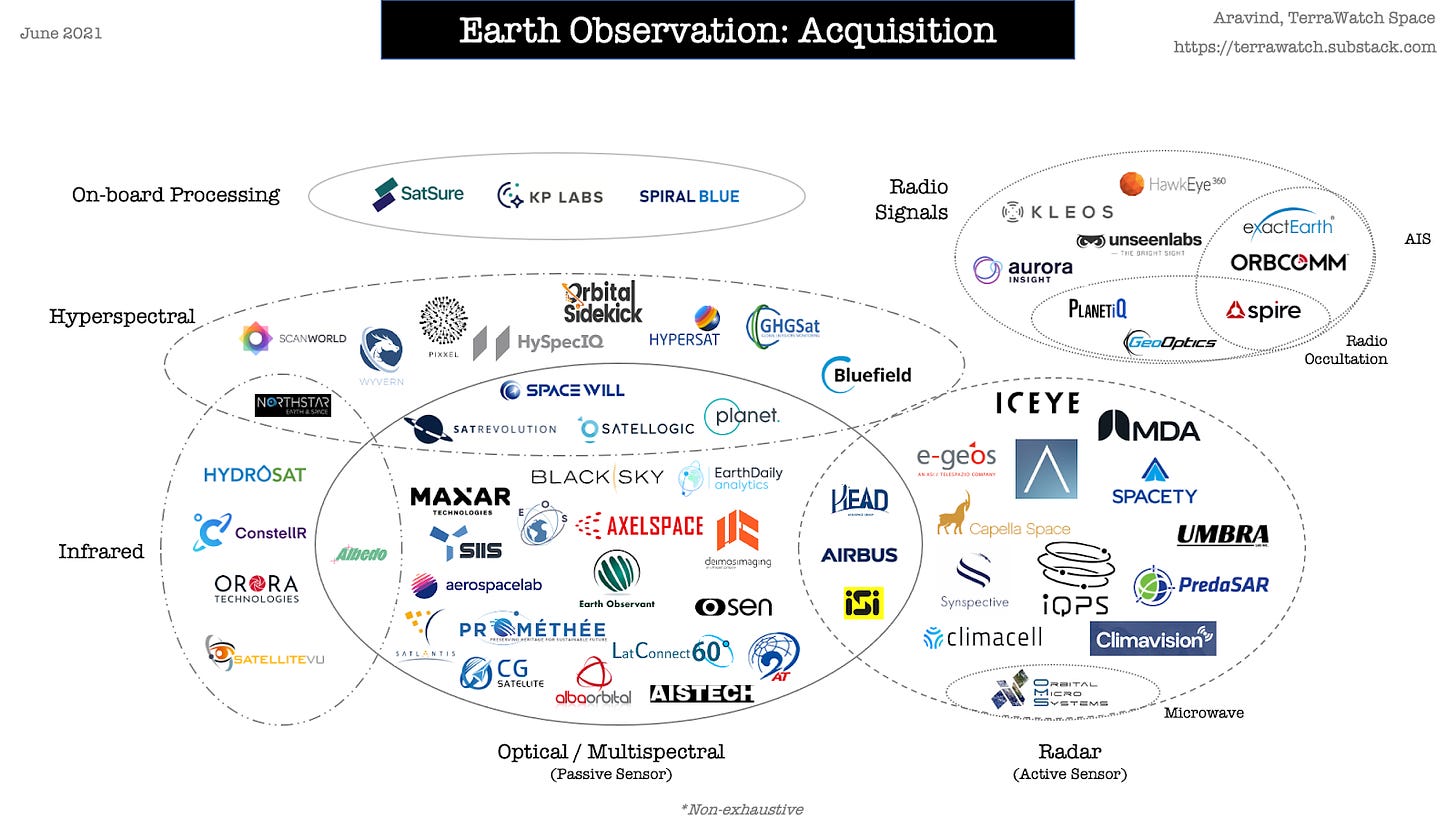

Data acquisition: How do we get that data?

These data points are acquired from sensors on planes, drones, boats, rooftops, and all the way to the bottom of the ocean. As the cost of space launching drops, satellites are increasingly being used to collect earth observation data. For the scope of this feature, we’re laser focused on satellite acquisition of earth observation data.

Satellites are (unsurprisingly) extremely expensive to build and launch. Historically, only government agencies and corporations with deep pockets would even attempt to launch satellites, but startups are quickly sending venture capital dollars into orbit as innovation accelerates. Whereas prior generations of satellites cost hundreds of millions to manufacture and at least tens of millions to launch, disruptors like SpaceX now advertise launching next-gen satellites starting at $1m. Startups are responding by making super low-cost low-orbit satellites, with some that cost just thousands to manufacture.

Satellite technology taxonomy

Resolutions are like the taxonomies of satellites. Here are the most important categories:

Spatial resolution: aka the size of pixels, which affects the clarity of the image. Spatial resolution of 1 meter means that each pixel shows a 1m x 1m area on Earth’s surface.

Spectral resolution: aka the detected part of the electromagnetic spectrum. There are two broad spectral categories: 1) passive, or solar reflection of light and 2) active, which sends out a pulse to the surface and detects the bounce back - including at night and during inclement weather.

Temporal resolution: aka speed at which the satellite revisits the same point. This is dependent on the satellite’s trajectory and orbit height.

Radiometric resolution: aka brightness or number of measured shades (50, gray, specifically)

Examples of satellite data acquisition companies: Spire, GHGSat, Capella Space, Umbra, Pixxel, Planet Labs, Airbus, HawkEye, Satellogic, Maxar, BlackSky, e-Geos, Iceye

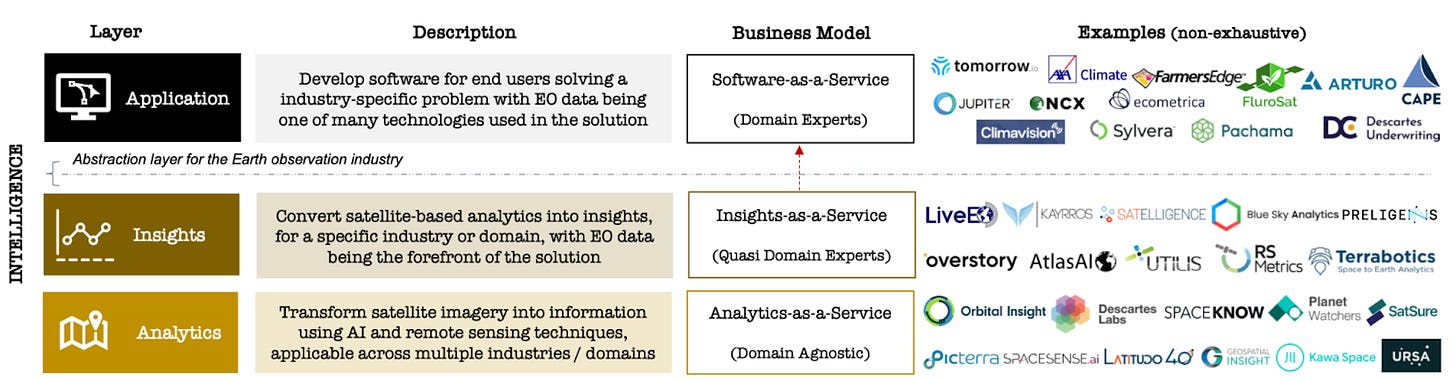

Data intelligence business models

It’s not the size of the dataset, it’s what you do with it. After companies use satellites (and drones, and boats, and land-anchored sensors) to acquire essential climate variable data, another layer of Earth observation companies derive signal from the noise. Space industry market analyst Aravind Ravichandran posits that this Earth intelligence layer consists of three parts:

Analytics: transforming imagery data into information using AI

Example: extracting industry-agnostic information on the number and location of cars, trees, buildings, etc.

Business model: recurring revenues through pay-per-use or subscription models

Insights: vertical-specific conversion of analytics into insights

Example: identify and monitor changes and discrepancies in vegetation, methane leaks, key assets, etc.

Business model: project-based, with some emerging software solutions

Application: problem-first software solutions backed by Earth observation insights

Example: remote measurement, verification, and reporting of forest carbon content, weather, insurance risks, etc.

Business model: “productized” SaaS

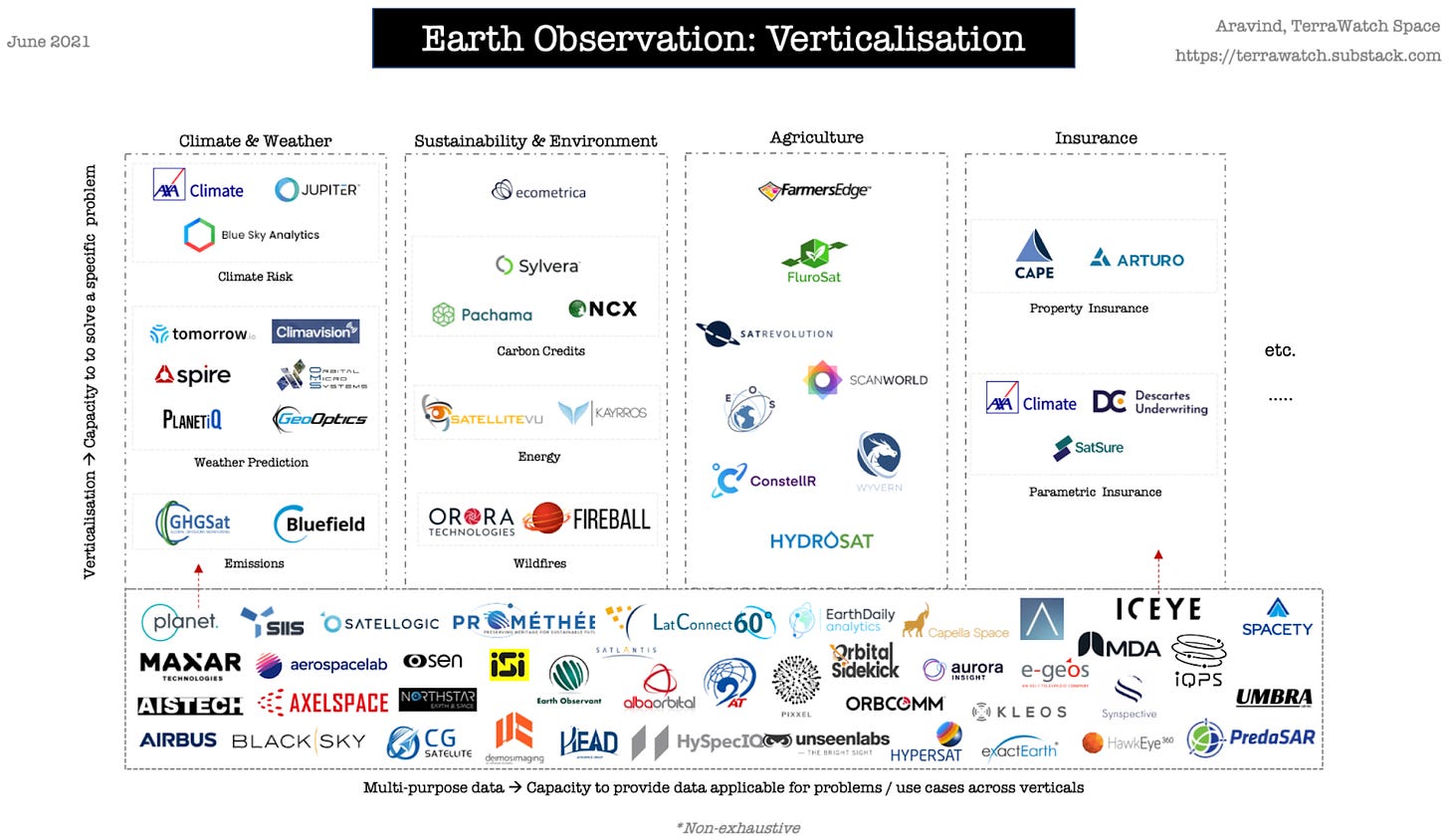

Verticalizing the intelligence stack

As Earth observation data commodifies with Analytics businesses’ increased distribution, and as Insights businesses find product-market fit within large addressable markets, we can expect verticalization. Within climate tech, verticalization will manifest as a convergence of analytics, insights, and application around specific application areas like carbon credits, wildfire, weather prediction, energy asset monitoring, and agriculture.

Climate applications of satellite Earth observation intelligence

⚡ Energy & Emissions

While point source applications like oil & gas wells can be monitored by terrestrial sensors, satellites are particularly useful for gathering a complete picture of energy assets’ often remote and internationally sprawling footprints. Further, though globally impactful, emissions data is collected on a national level - to varying degrees. Progressively, private companies are increasingly active in emissions monitoring, which was previously the purview of government and public satellites.

Representative startup: GHGSat gathers data on greenhouse gases like methane, and attributes the emissions to individual sources.

Startups: Bluefield (methane leak detection), Kayrros (analytics platform for energy monitoring) Satellite Vu (thermal monitoring for climate monitoring), Solargis (solar irradiance data), WEGAW (snow and water prediction for renewables)

☂️ Climate risk & Weather

As wildfires, floods, and droughts increase in frequency and severity, satellite Earth observation companies can provide a real time, birds eye view into disasters as they unfold – and, combined with historical data, generate better predictions of future catastrophes.

Representative startup: OroraTech leverages satellite imagery to better detect, track, and monitor wildfire threats. After building a wildfire intelligence platform to process third-party satellite data, Orora is vertically integrating up the stack and developing a constellation of infrared sensor nanosatellites.

Startups: Fireball (early wildfire detection), Overstory (vegetation intelligence), Divirod (precipitation monitoring for tailings ponds, reservoirs, roofs), Blue Sky Analytics (environmental datasets using satellite imagery and AI) Tomorrow.io and Climavision (weather intelligence), HailStrike (hail storm tracking)

💨 Carbon Markets

Verification and measurement are major cost drivers of carbon credits – and areas of increasing scrutiny. Satellites’ scale and automated nature hold promise to drive down costs while improving accuracy and reliability.

Representative startup: Pachama uses LiDAR and high resolution imaging to measure the carbon and biomass content of forests, track deforestation, and source new forest carbon projects.

Startups: Albosys, Sylvera, NCX, Cloud Agronomics

🌾 Agriculture

Spectral satellite crop monitoring enables real-time precision farming and yield estimates. Farmers use this intelligence to improve practices, insurers set rates, investors deploy capital, and governments assess food security. Given the scale and distributed global footprint of agriculture, satellites uniquely provide high frequency, broad, yet detailed intelligence.

Representative startup: Gro Intelligence aggregates satellite imagery with global agriculture data to forecast planting intentions, pest and disease spread, and mitigate risk from climate and drought.

Key Takeaways

Satellites are not silver bullets in the sky. Compared to terrestrial sensors, satellites tend to be more costly, less frequent, and less detailed. To measure the emissions footprint of a specific asset like one datacenter, install a localized suite of sensors. Or to perform a maintenance check up of grid infrastructure, send a fleet of drones to collect data. But to monitor swathes of forest for wildfire threats, or private assets for leaks, satellite intelligence provides a continuous All Seeing view. Generally speaking, if a reasonable terrestrial point solution exists, don’t look to the sky for answers.

Don’t compete with the government. Public datasets are deep, widely used, (see: United States Geological Survey, Copernicus, NASA Worldview) and have decades of head start (case and point: 1970s Landsat program). Private satellite data competitors must differentiate from free, public sources on quality, resolution, business model, analytics, or other offerings.

Beware 7-figure launches. Despite plummeting launch costs fueled by the likes of SpaceX opening up access to space, manufacturing and managing a satellite racks up multitudes of 7-digit costs. Comparatively, terrestrial sensors are many orders of magnitude cheaper.

As more satellites go up, verticalized players will stack up. The future of Earth observation will be verticalized - companies will develop problem-specific capabilities, as access to (high quality) general data on Earth variables commoditizes. Differentiation (and therefore value) will be earned by those with better insights, in addition to better data.

Business models are still up in the air. Unlike communication satellites (and defense) which turn on revenues right after launching, earth observation satellites’ business models require extensive additional effort to extract commercial value from the raw data. While some companies like Blue Sky Analytics are selling access to broad API-based satellite imagery datasets, other players are adopting a client-specific ‘tasking’ business model in which they charge for a frequent revisit rate of specific locations.

It’s up and up for satellite Earth intelligence platforms. Greater availability and precision of Earth observation data will increase customer ROI. In turn, more entrepreneurs will build analytics, insights, and ultimately applications products on top of this novel satellite data platform.

Thanks to the many “spacexperts” who helped to launch our understanding of this complex market off the ground. In particular, climate-linked risk transfer fund Nephila Climate (where CTVC’s Kobi Weinberg works), and space industry consultant Aravind Ravichandran. Watch Aravind’s Twitter and TerraWatch Space for more posts on spacetech climate applications.